As i noted on 2/10/06, all my indicators were compressed in a wedge. Today the CCI broke out of that compression. My MACD indicator had a crossover. My system gave a buy signal at the close on the SPX daily charts. Note that my system is based on the indicators i have shown in the above charts and some more. But the buy/sell signals are based on objective intrepretations of the indicators, which are strictly rule based without any of my subjectivity coming into picture.

Momentum is always a leading indicator, which breaks out before the price. The price is yet to take out the declining tops line, which would add confidence to the signal. Bottomline, my daily is on a buy as of today's close after being on sell since 2/2/06, which means i will start buying pullbacks instead of shorting strength.

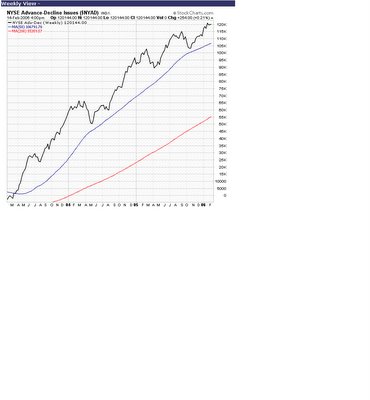

Meanwhile, the NYSE weekly A/D line continues to remain in a very constructive mode. Hard to get bearish, from a intermediate term perspective, against such strong inflows of liquidity into the marketplace .

No comments:

Post a Comment