Firstly, i truly beleive that future cannot be predicted, be it the future of stock market or the economy or our lives. Hence one cannot make one's life's decisions based on those forecasts. So the implication is one cannot trade one's forecasts, but should only trade the trend, based on sound money management. However, i truly beleive that the future path of the market can be probabilistically predicted with high odds of success. From various TA methodologies i have studied, i have found e-wave theory to be the most useful for making long term market projections.

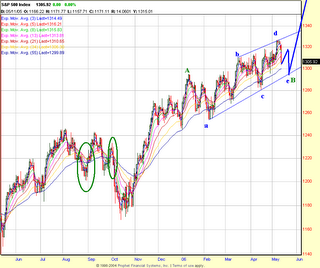

Here's my big picture e-wave count. I will reserve the detailed explanation and reasons behind this e-wave count for another article.

To see an enlarged version of the charts below, please click on it

IMO the current bull market has a couple of more years of run-up left, before any large correction kicks in. I beleive that we are in a Cycle degree wave 4 correction. The last Cycle degree correction (Cycle degree wave 2) lasted for 16 years between 1966-1982. Since i beleive this to be a Cycle degree wave 4 correction, if this correction should take the same time as wave 2, then it should end somewhere around 2016. Although i agree with the bears that this correction will end somewhere around 2014-2016, i part ways with them when it comes to how that correction is going to unfold and where that bear market bottom is likely to form.

There are three schools of bearish thoughts today.

1) Secular bear market

2) Mutli cyclical bear market

3) Cyclical bear market

Secular bear market

The first school "Secular bear market" folks are armageddonists, who beleive a Grand super cycle degree top has formed in 2000 and we should eventually break below the secular lows of 1982 at DOW 769. This school comprises primarily of deflationary depressionists. Even before we start talking about a secular bear market, we should at least break below the Oct 2002 lows. Until then this school of thought is an arena of TA fantasy and/or delusion.

Multi-cyclical bear market

The second school of thought beleives that we are in a secular bear market, yet they can't take the leap of faith a la Prechter to call for market lows below the prior secular bottom at 1982. It's kind of oxymoronic to call we are in a secular bear within the context of a secular bull, without calling for price lows below the prior secular lows of 1982. Although the term "Secular" is loosely bandied about by this scool, they are in fact calling for a multi-cyclical bear market. Obviously this school defines the secular bear in terms of time, by being non-commital on price. This school has a combination of deflationists, hyperinflationists and kondraitief theorists.

Cyclical bear within a Secular bullThe third school (includes me) believes that we in a secular bull market, but a cyclical bear is unfolding in the context of a secular bull. The very fact that the S&P 500 suffered a 50% correction, the largest correction since the advance begun in 1982, means that the secular bull from 1982 has ended. A secular bull ending does not put us automatically in a secular bear. The end of the secular advance has given birth to a cyclical bear, once complete, should start another secular advance.

What's happening now ?Bears argue that the bear market did not end in 2002. Two main reasons often cited are that we did not see the capitulation in terms of sentiment compared to the prior bear market lows. The P/E did not revert to the historic mean or to the levels seen in prior bear market bottoms.

But one has to remember that cycle degree corrections are rarely simple A-B-C type corrections. Bull market often begin with as few folks on its back as possible. We live in an information age and every average bear out there knows that you buy stocks for long term when there's blood on the streets. Every average bear knows that the time to invest for the long term is when the P/E reverts back to single digits, like it did in 1982. Every average bear knows that a wave C will follow a wave A. In other words, there's an army of wannabe Warren Buffets waiting for the blood on streets to buy this market with both the hands. As the market keeps advancing relentlessly, as it has been since the 2002 lows, the bearish emotion and bearish frustration keeps rising. The thinking among the bears predominantly today is "I am smart and will wait in cash. Let the lemmings be led. When the bulls lose their shirts and the P/E revert to the bear market bottom levels, i will buy cheap". Will the market accomodate this army of bears waiting to buy cheap or shorting this market recklessly ? If history is any guide, these folks will capitulate big time, right near the market top. Market has its own devious ways of keeping most folks out the market.

Bull markets do not begin when the economy is in a state of utopia. It needs that constant wall of worry, to keep the majority from participating. I think the housing market decline over the next few years from the mania top of 2005 will provide fresh fodder for the bears to worry and the wall of worry for the bull market to climb. In my opinion, the housing and the deteriorating economic fundamentals going forward will be the hook which will keep the majority from participating in the bull market going forward.

The best way to predict the stock market IMO is to look at the stock market itself. You can't predict the stock market by looking at Bonds, Dollar, Gold or even the Economy for that matter. Although correlations exist between these markets, those are not static correlations, but one which changes over time. What was the stock market saying in 2002 Oct ?. Well, it was a screaming bear market. Being bearish then was the right thing to do. Bears extrapolated the market decline into the end of civilization. The market demise was predicted with rational certainity using various TA methodologies, but all arriving at the same conclusion and the same dates for dark ages. All archived discussions at longwaves.net should be an eye opener for all the new bear cubs that are being born today. What went wrong with these folks ?. ("These folks" include me as well - i was a raging bear then !). Kondraiteif winter, a wave 3 of 3 down, currency collapase, a depression that would put 1929 to shame, credit implosion, housing bust, breadlines et al ? I think the problem lies in trying to predict one unknown variable with another unknown - The two variables being economy and the stock market.

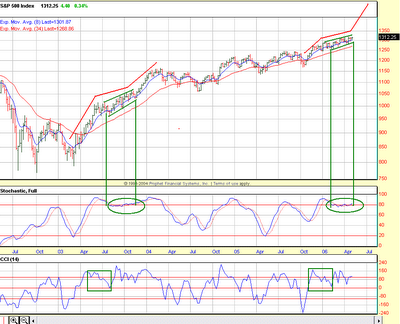

Where are we now ?The monthly trend turned up in the stock market in the fall of 2003 and since then we have been in a bull market. I went back and searched as to what happened when the monthly trend turned up after a crash or a major selloff. I have shown five examples here - 1929 DOW crash, 1987 DOW crash, 2000 S&P meltdown, 2004 BSE (Bombay stock exchange) crash.

They all exhibit the same characteristic. Once the monthly trend turns up from a "crash bottom", they start a 45 degree ascent, slowly grinding sideways to up, keepping the bears hopes alive. The momentum divergences on the monthly charts keep the bulls from not talking any long term bets. The 45 degree ascent also is a psychological barrier for making long term bets as it looks ugly on the charts. The e-wavers keep calling it a corrective advance until new recovery highs are made. The memories of the prior meltdown also makes it difficult to make long term bets. Essentially the majority shys away from making long term bets, which results in a choppy sideways-to-up grinding markets without a sustained trend on the daily charts. However the trend is clear and visible on the monthly charts. This market profile/structure and the associated psychology makes sure that the majority is out of the bull market and market keeps climbing the constant wall of worry without creating euphoria quicky.

The slow sideways advance also helps to correct the P/E ratio downwards. As we have seen the S&P has advanced nearly 550 points from the 2002 lows, while the P/E has been declining. Now as long as the stock market keeps advancing at a slower rate than the earnings growth, we could end up seeing a P/E in the low teens or even single digits, at all time highs on the SPX. Imagine the horror among those waiting to buy this market at low P/Es, when forced to buy at ATH on SPX. Of course, i am just extrapolating what has happened from 2002 lows going forward, which may or may not happen - but is not something beyond the realm of possibility, given what has happened so far !

Now how can a corrective structure/advance take out the prior market highs ?Under e-wave, we have upward biased corrective structures and downward biased corrective structures. Flats and Zig-zags are downward biased corrective structures in an uptrend. What most bears are expecting today is a regular flat or zig-zag taking us below Oct 02 lows.

Running Flat (or a irregular flat ) and Running triangles are examples of upward biased corrective structures in an uptrend. In case of Running flat or Irregular flat, the wave B highs are formed above the wave A highs and the wave C lows form above the wave A lows. I belive we are in one of these two upward-biased corrective formations and below are the e-wave counts of what i think is about to transpire over the next few years.

Now why do i think that the market is forming one of these upward biased corrections as opposed to downwards biased corrections(like a zig-zag or a regular flat) ? The reason is the message sent by the markets itself at this point. Think about it. DOW is just 200 points below the all time highs. One big day could put us into ATH and crush the secular bear market argument. Now will the bears concede defeat if DOW makes ATH ?

Bookmark this - DOW ATH will only make the bears more bearish. If DOW ATH were to occur, then the argument will shift to the massive inter-market divergences between the DOW, S&P and the Nasdaq. So the bears will start arguing that Nasdaq and S&P made their secular tops in 2000, but DOW is making it's secular top in 2006. In other words, the bearish sentiment will rise to all time highs, with the all time highs in DOW. Bottomline is as the market advances from here, the sentiment which is already extremely bearish will only start getting even worse. Bears have been arguing that Fed has painted itself into a corner. In reality, it's the bears who have painted themselves into a corner here, if the DOW were to make ATH. They can neither remain bearish nor can they turn bullish. The real capitulation would only come later with ATHs in SPX.

Putting the sentiment argument aside, let's look at the structure of the market from 2003 lows. Clearly we are in the middle of a massive upsloping channel from the 2004 highs.

This is not a wedge, as it does not satisfy any of the ending diagonal requirements in term of structure and internal wave relationships. As the structure has been maturing from 2004, it is getting more and more clear that it's a large irregular flat from 2004. The upsloping nature of the correction itself attests to the upward bias of the markets. Once the upper trendline from 2004 gets taken out, then we could safely say that a wave C of B (of a primary degree has begun). As for intermediate term, i belive that we have not yet seen the 4-year cycle lows. Based on the current wave structure, we could see a move to SPX 1270-1280 by early November and then a quick selloff to around SPX 1240 to fill all the gaps that we have left below, since this IT advance begun in July. The most widely watched 4-year cycle bottom in the history could be in March-April 2007, instead of Oct-Nov 2006 as is being widely anticipated today, based on the current wave structure and time relationship. And the 4-year lows will most likely hold above the 2006 lows.

Cyclically speaking, the extreme right translation of this 4-year cycle also attests to the upward bias of the market and any upcoming 4-year cycle low will be a non-event. The next 4-year upcycle should take out the 2000 top on SPX, based on what the current wave structure is implying.

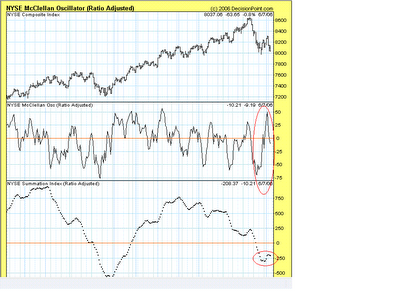

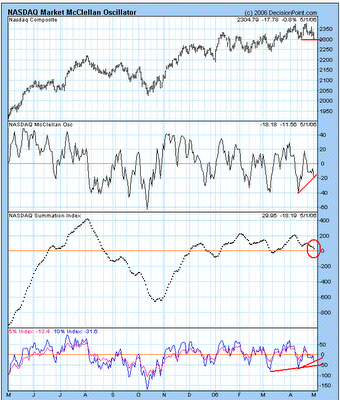

Last but not the least, the all time highs on the NYSE A/D line is also screaming that this advance is far from over.

Once those 4-year lows are behind us, we should begin a persistant market advance from 2007 in a wave C upmove. Wave C should take us to about SPX 1620 (if wave A = wave C) or about SPX 1860 (if wave C = 1.618 * wave A), before this BULL market tops out, most likely by late 2008 to early 2009. By then, most of the bearish caucus will have worn out/capitulated leading the way for a primary degree wave C decline.

Remember the market could also take the form of a running triangle.

If that happens, it could end up as the bear trap of the millenium, giving no exit for the bears, other than to capitulate en masse. If this scenario were to transpire, then the market volaitlity will start shrinking as we advance into the apex of the triangle, making the market a trader's nightmare. This is what happened from post 1987 crash to 1995 (wave 4), when the market grinded sideways to up slowly and spurted up in a sharp wave 5 move into 2000. This time may not be different, except that its happening at a higher degree !