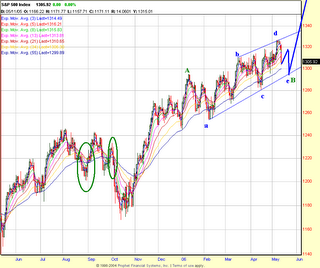

This is as trendless a market i have traded in years. Here's the reason. The market is forming a running triangle, confusing the heck out of everyone. Every daily buy signal lasts two days. Every daily sell signal lasts for two days. But that's the function of the market pattern we are in. I will perhaps have my buy signal fail here, very likely. (a break of 1295.56 swing low will cause my buy signal to fail). This will be the second consecutive signal failure this year after 8 consecutive signal successes.

Perspective is everthing. There's already crash talk on the message boards after a day of decline. Just take a loook at the above chart and see if it's bullish or bearish. By no known measures of trend and momentum analysis can the above market structure be construed as bearish. The market entered the zone of vulnerability only twice over the last year, both happened in the fall of 05, which i have circled in green. Look how the EMA ribbons curled over and crossed the blue line. That's the point of maximum concern for longs. That's the zone where mini-crashes can happen. I have checked back in the history for the last 100 years and no crash/mini-crash has come out of the blue before those darn ribbons curled and crossed over. And of course there are certain momentum signatures before those mini-crashes happen.

If my e-wave count is right we should see a bounce tommorow followed by a failure and retest of the SPX 1290-1296 region and a sharp rally following that. The Nasdaq MCO is forming a positively diverging bottom w.r.t price as long as the April lows on the MCO hold. The NYSE cumulative A/D is still in a bullish configuration. What would turn me bearish here ? - A break of SPX 1280, which would turn the intermediate term down. So until proven otherwise, i am looking for a buying opportunity again.

No comments:

Post a Comment