Daily Momentum - Sell, Daily Trend - Sell

Weekly Momentum - Sell, Weekly trend - Neutral

Monthly Momentum - Sell, Monthly trend - Up

At this juncture, it's hard to predict what would happen next. One can only observe the market on a day to day basis and look for clues. One thing is for sure - the trend is down. That does not make trading easier, as one has to negotiate with the violent snapback rallies.

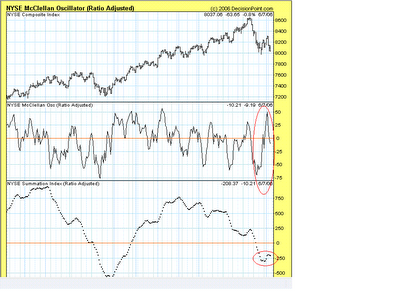

Technically the market is in a setup for a nasty decline. The key remains whether the 1245 lows on SPX holds or not. If it holds, we could see a sharp 40-50 points rally. That seems very unlikely at this juncture. On the other hand, a voilent decline looks more probable. Once we break 1245, it would confirm that wave C is in progress, which would target a minimum of SPX 1200. There's simply no support until then. The reason i think that a sharp decline is possible here is based on the internals. Look at the coast-coast movement on the NYSE MCO. The MCO moved from -70 level to +50 level, which was a pretty broad based rally, which sucked in a lot of money into markets hoping that the worst is over or the "V" shaped bottom was in. Now the same MCO has encountered a failure and is now back below the zero level. This has now turned the summation index back down, but this time it's turning down while it's below the zero line !. That's what i call a setup for nastiness. Now the same money which entered the markets pushing the MCO to 50 is panicking and leaving the markets. Once the stops below 1245 are triggered, it could blossom into a climax.

Also notice in the above chart, both the CCI and the MACD are issuing secondary sell signals. Again the MACD is issuing the secondary sell below the zero line. Which is why we are seeing that severe weakness in the marketplace. I had a 120-min buy signal yesterday which is typically good for 20-30 SPX points in a orderly market. All we got today from that signal was a mere 12 points and it abruptly turned down and erased all the gains in one single 120-min bar. That says a lot about the weakness in the markets. This is not the average joe-sixpack panicking here. It's the big boys panicking here. Cash smells good! Capital preservation is the key in these times.

I will try to post my hourly swing buy and sell signals here as the daily will continue to be on a sell for quite sometime.

No comments:

Post a Comment