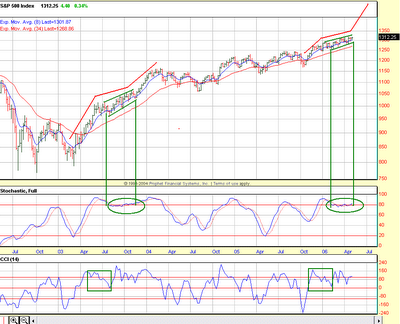

The fractal we are witnessing from Oct 05 is an exact mimic of the A-B-C Fractal that we witnessed from March 03 - Jan 04. July 03 thru Oct 03, we were in this running triangle and then broke out of it and melted-up.

We see the same running trianlge here from Feb 06, which is about to finish and switch into a terminal move. My custom Full Stochastic has the exact same signature, flatlining about the 80 line and turning up. Remember overbought weekly indicators turn down. They rarely don't. On those rare instances when they don't turn down and instead turn up, price goes parabolic. That's what we are seeing on the Full Stoch.The CCI has the exact similar signature prior to the beginning of the running triangle and then showing hesitation (i.e chopping around the 100 line) before the big move. Price action then was around the 8 EMA, which is the case now. Similarities are just uncanny.

Sentiment-wise, there was this tremendous disbeleif then, like we have today. Folks were expecting a 9-month cycle bottom then. Now the talk is all centered around the 20-week bottom. Every messageboard i visit, i see this talk about the 20-week cycle bottom. Then in 2003, the internals bottomed during the 9 month cycle bottom while the price made a higher bottom. We are seeing the same again. The summation index is making it's trip to the zero line, i.e the internals are bottoming while the price keeps moving higher.

The NYSE MCO has moved above the zero line. Now if we see a good breadth thrust day, that would create a zero-line rejection on the summation index and would be a good intermediate term buy signal. For now, waiting and watching for the resolution...

No comments:

Post a Comment