Hourly sell from Tuesday is still in effect. We had a post election gap-down, which pushed some VST indicators to extremes, causing that recovery on Wednesday. Today we gave up all that gains. Now the hourly is nowhere near oversold conditions, to worry about any major rally here. Based on 30-min and 60-min indicators, we could bottom tommmorow morning somewhere around the 1376-78 area, which should lead to a small bounce before another leg of selloff starts....

Bottomline: ST bearish, IT neutral, LT bullish.

Thursday, November 09, 2006

Tuesday, November 07, 2006

No blowoff !

I was wrong yesterday expecting a blowoff to SPX 1398. SPX went to 1388, double topped and sold off. As we approached the double top area, i posted this heads up on traders-talk.com

http://www.traders-talk.com/mb2/index.php?showtopic=62140

One chart says it all for today ! 60-min is now back on a sell. This signal has a pretty good track record catching the hourly swing turns. Fade it at your own risk.

http://www.traders-talk.com/mb2/index.php?showtopic=62140

One chart says it all for today ! 60-min is now back on a sell. This signal has a pretty good track record catching the hourly swing turns. Fade it at your own risk.

Monday, November 06, 2006

Terminal blowoff !

The bounce that i described yesterday came right on schedule. Now i am pretty sure, based on the e-wave pattern that we are in a terminal blowoff, which should take SPX cash to 1398-1400 region and conclude the intermediate term advance from July lows. Once this IT advance concludes, we should see a multi-month selloff in SPX to about 1300-1320 region.

Sunday, November 05, 2006

Approaching a traedable bottom

Remember the first chart that i posted on this blog on 10/27, warning a potential ST top. The call was right on the money and we satisfied out ST objective of ES 1367. Now the second chart is showing the MACD right at the zero line support. Howvever the CCI has a teeny bit of work to do on the downside. What is more important is that the hourly chart is showing positive divergences and the 120-min is putting a complex bottom on the Full Stoch. All of these are warning signs that a traedable bottom is approaching. I am seeing the ES 1358-1364 zone as a potential bottoming zone. We might mess around this zone for the next day or two. But the risk of rally increases here. I will be playing the long side this week.

Wednesday, November 01, 2006

What next ?

1370.75 it was ! Remember my call from yesterday was for a move to ES 1367-1370 - we acheived that technical objective today. Technically it was a nasty move - a 3 sigma move. On the 120-min chart i have shown 3 instances from 9/11/06 when we hit the 3 standard deviation band (on 20 EMA). Two of the prior instances on 10/3 and 10/11 resulted in barn burner rallies. Will it be a replay of the same this time ? I don't think so. Notice the bands were compressed in the prior two moves, while it's expanding and turning down now i.e a potential change in trend. The daily context was on a solid buy then, and back then i was a frothing bull. Right now the daily is on a momentum sell. Well, anything can happen in markets, but we have to play the odds. Given the 3 sigma touch today at 1370.75, a reflex bounce is a given, which is why i covered all my shorts at 1372, which i posted in real-time on traders-talk. Now how big is the bounce gonna be is anyone's guess. Given the technical condition, any bounce tommorow morning will be likely sold. So will reshort on any bounce and see how it goes. If the selloff results in a positive divergences on the hourly charts, i will consider going long for a counter-trend trade. If we break 1367 and accelerate to the downside, it can get nasty in a hurry. It's all speculation at this point. Gotta watch the tape tommorow to see what happens. For now, i am neutral, but looking to short tommorow morning.

I don't have the time today. But i will definetely post the updated daily charts tommorow, which warned us last Friday.

Bottomline - Bearish ST, Bullish IT/LT

Tuesday, October 31, 2006

Land of the quick or dead !

All my indicators, measured move projections, dyanmic support on 120-min, dynamic support on daily, e-wave projections are all pointing to ES 1367-1370 area (SPX 1360-62 cash) for tommorow. BTW, someone dumped nearly 65000 contracts in the last 5 minutes of the trading. That's huge and means something. I guess we will know tommorow. They have been jerking the price all around, the last two days, confusing the heck out of the bull and bears alike. But the hourly trend indicators have been essentially saying the same thing, despite all those gyrations - DOWN !

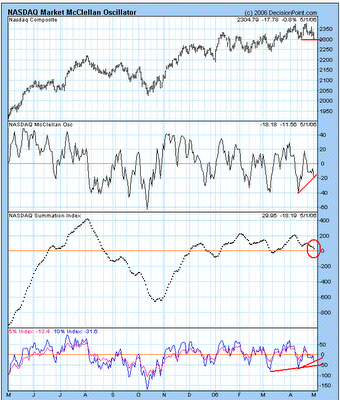

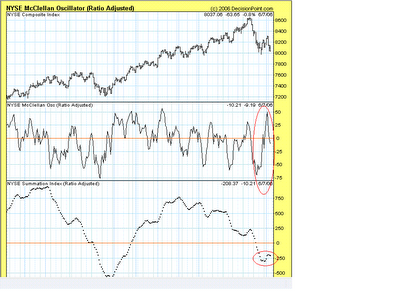

Another small change day on both the NYSE and Nasdaq MCOs. Two back to back small change days on the MCOs, which are not very common. Nasdaq MCO flipped below zero pointing the summation index down. NYSE MCO ready to plunge below the zero.

Tommorow will a strong day either up or down - no ifs and buts. The odds of a strong move down is about 80%. It's about as good as it gets in TA. If such strong odds do not transpire and the market decides to move above 1392 ES, i will throw aside all my opinions and join the long side. Right now, all my work points down and i remain short from last Friday. I don't have to sweat sitting on the house money. So will give it some time.

Bottom line - ST bearish, IT/LT bullish.

Another small change day on both the NYSE and Nasdaq MCOs. Two back to back small change days on the MCOs, which are not very common. Nasdaq MCO flipped below zero pointing the summation index down. NYSE MCO ready to plunge below the zero.

Tommorow will a strong day either up or down - no ifs and buts. The odds of a strong move down is about 80%. It's about as good as it gets in TA. If such strong odds do not transpire and the market decides to move above 1392 ES, i will throw aside all my opinions and join the long side. Right now, all my work points down and i remain short from last Friday. I don't have to sweat sitting on the house money. So will give it some time.

Bottom line - ST bearish, IT/LT bullish.

Monday, October 30, 2006

ES 30-min trend

Keeping it simple for now. The 30-min trend is clearly down for now. We need to just let the trend play out. The slow Osc is clearly down, with no positive divergences yet. The fast one is turning down. The key for tommorow is whether we can break the horizontal support at 1378. If we can't break 1378, then the downtrend could be in trouble and we could see a larger sideways consolidation i.e no money for bears unless you flip in and out based on the Fast Oscillators. If 1392 is taken out, then then the correction is over.

Small point change on both the NYSE and Nasdaq MCOs. So it will be an exciting session tommorow.

Bottomline : ST bearish, IT/LT bullish

Sunday, October 29, 2006

Rejection at channel resistance

The indicator i talked about yesterday which was warning about a potential top did produce a reaction which occurs near ST/IT tops. The MACD crossed over and the Full Stoch broke below 80, as i suspected. Look how nicely the price was rejected at the channel top (SPX 1389), which i have been talking about for the last 15 days. 1365-1388 SPX cash was my projected topping zone. We have likely topped for the ST and headed towards the first potential support at 1362 and then eventually towards the 1350-1355 area. According to my work, a weekly close below 1356 is required to confirm that a IT top has occured. Otherwise this would end up as another ST top and a retest of the current highs cannot be ruled out.

Bottomline : ST bearish, IT/LT bullish.

Friday, October 27, 2006

Warning signs for longs

Per my Oct 13 comments, we were in a topping zone from 1365-1388. Yesterday SPX cash hit 1389, satisfying that objective. We are now right at the top of the channel. While the first 120 point rally off of the June lows barely had any believers, the last 30 point rally has generated enough cocky bulls and the parabola dreamers. Now a reaction off of this zone has to be expected any day. There will come a out of the blue decline, for which there will be no reason or no news behind it.

One of my indicators has flashed a warning sign for the first time since this rally leg begun on 9/11/06. Look at the fast MACD, which had a series of higher highs from 9/11/06. For the first time since 9/11/06 , this indicator generated a momentum divergence yesterday. Also we have the Full Stoch crossed over and ready to plunge below 80. Again this is just a divergence at this point. If we get a strong rally today, the divergence can get erased. On the other hand, if we close in red today, not only will the MACD crossover, but the Full Stoch will also drop below 80. This would then be the first traedable decline since 9/11. At this point, it's only a warning to longs, but not a short signal yet. Will know by the end of the day. Stay tuned...

One of my indicators has flashed a warning sign for the first time since this rally leg begun on 9/11/06. Look at the fast MACD, which had a series of higher highs from 9/11/06. For the first time since 9/11/06 , this indicator generated a momentum divergence yesterday. Also we have the Full Stoch crossed over and ready to plunge below 80. Again this is just a divergence at this point. If we get a strong rally today, the divergence can get erased. On the other hand, if we close in red today, not only will the MACD crossover, but the Full Stoch will also drop below 80. This would then be the first traedable decline since 9/11. At this point, it's only a warning to longs, but not a short signal yet. Will know by the end of the day. Stay tuned...

Tuesday, October 17, 2006

Three strikes and....

Friday, October 13, 2006

Intermediate Term market thoughts

My system genearated a Weekly buy signal on the SPX on Aug 6, which i posted on traders-talk.com.

http://www.traders-talk.com/mb2/index.php?showtopic=57534&hl=weekly+buy

There were a lot of disbeleivers then and the disbeleivers in the current rally continues. I have been playing the long side since then, but now the IT is getting long in the tooth. So the free ride is essentially over and the risk of an unexpected selloff increases as we complete this topping process. In the VST, i expect a selloff to near 1240 and then another leg higher. The 120-min momentum needs to rollover for the 1240 scenario to work. Otherwise, we could blow off straight towards 1288.

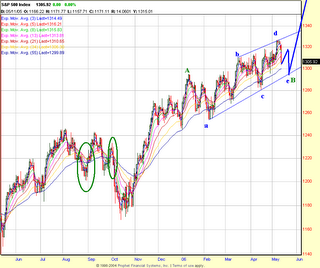

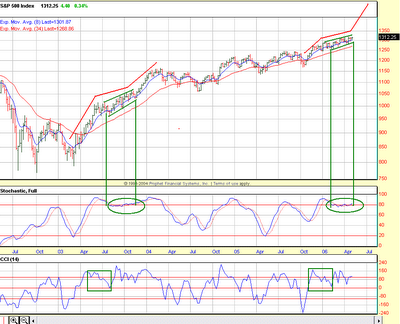

To get a perspective of what's happening. Wave A from the 2003 lows ended in March 04. Since then we have been building this massive upward sloping siwdeways flag, an irregular flat in elliotwave terms. This massive sideways flag which we most likely finished with that plunge in May-June 2006, was the wave B. Now we have very likely embarked on an intermediate degree wave C which should go up and eventually take out the 2000 highs on the SPX. Initially i thought that the wave B was not finished and we would move down and retest the June 06 bottom to fill all the gaps. It still is not beyond the realm of possibility !

My latest thinking is that we are very unlikely to retest the June 06 bottom anytime soon. The recent advance has been the fastest (not yet the largest wave), since the corrective wave begun in 2004. Now the speed of this advance and the angle of ascent is loudly saying that a new impulsive wave to the upside has begun. The design of the wave C is unknown at this point and could either be a true impulse i.e 5 waves or a terminal wave C. More time and price action will be required to confirm the structure of wave C.

As for the near term, the IT advance from June lows is now getting long in the tooth. We are bumping into some serious resistance from the channel containing the corrective wave from 2004 as well as the resistance from Dec 2000 monthly high. Look how nicely they are converging near 1388 SPX cash. Gotta love TA. This twin resistance will prove formidable to overtake on the first run. So essentialy we are in a topping zone from SPX 1365 to 1388. A reaction could start anytime fom this topping zone. How low the reaction would take us, is a crapshoot at this point. It could find support at either the 38% or 50% Fib retracements to the June lows. So our support zone for any reaction here should come between 1300 - 1320 SPX cash.

It's amazing how sentiment works. All these days when we were miles away from all these formidable resistances, there was so much scare in buying the dips. Now that we are approaching the same resistances, there's no fear. It's all about parabolic rises, primary degree wave 3 of 3(which is a baloney IMO -will post more on that), epicenter, blah, blah, blah. Show them a 20 point reaction and all the parabolic talk will change to Nikkei crash, 87 crash, 29 crash.....

http://www.traders-talk.com/mb2/index.php?showtopic=57534&hl=weekly+buy

There were a lot of disbeleivers then and the disbeleivers in the current rally continues. I have been playing the long side since then, but now the IT is getting long in the tooth. So the free ride is essentially over and the risk of an unexpected selloff increases as we complete this topping process. In the VST, i expect a selloff to near 1240 and then another leg higher. The 120-min momentum needs to rollover for the 1240 scenario to work. Otherwise, we could blow off straight towards 1288.

To get a perspective of what's happening. Wave A from the 2003 lows ended in March 04. Since then we have been building this massive upward sloping siwdeways flag, an irregular flat in elliotwave terms. This massive sideways flag which we most likely finished with that plunge in May-June 2006, was the wave B. Now we have very likely embarked on an intermediate degree wave C which should go up and eventually take out the 2000 highs on the SPX. Initially i thought that the wave B was not finished and we would move down and retest the June 06 bottom to fill all the gaps. It still is not beyond the realm of possibility !

My latest thinking is that we are very unlikely to retest the June 06 bottom anytime soon. The recent advance has been the fastest (not yet the largest wave), since the corrective wave begun in 2004. Now the speed of this advance and the angle of ascent is loudly saying that a new impulsive wave to the upside has begun. The design of the wave C is unknown at this point and could either be a true impulse i.e 5 waves or a terminal wave C. More time and price action will be required to confirm the structure of wave C.

As for the near term, the IT advance from June lows is now getting long in the tooth. We are bumping into some serious resistance from the channel containing the corrective wave from 2004 as well as the resistance from Dec 2000 monthly high. Look how nicely they are converging near 1388 SPX cash. Gotta love TA. This twin resistance will prove formidable to overtake on the first run. So essentialy we are in a topping zone from SPX 1365 to 1388. A reaction could start anytime fom this topping zone. How low the reaction would take us, is a crapshoot at this point. It could find support at either the 38% or 50% Fib retracements to the June lows. So our support zone for any reaction here should come between 1300 - 1320 SPX cash.

It's amazing how sentiment works. All these days when we were miles away from all these formidable resistances, there was so much scare in buying the dips. Now that we are approaching the same resistances, there's no fear. It's all about parabolic rises, primary degree wave 3 of 3(which is a baloney IMO -will post more on that), epicenter, blah, blah, blah. Show them a 20 point reaction and all the parabolic talk will change to Nikkei crash, 87 crash, 29 crash.....

Sunday, September 24, 2006

LONG TERM MARKET THOUGHTS

Firstly, i truly beleive that future cannot be predicted, be it the future of stock market or the economy or our lives. Hence one cannot make one's life's decisions based on those forecasts. So the implication is one cannot trade one's forecasts, but should only trade the trend, based on sound money management. However, i truly beleive that the future path of the market can be probabilistically predicted with high odds of success. From various TA methodologies i have studied, i have found e-wave theory to be the most useful for making long term market projections.

Here's my big picture e-wave count. I will reserve the detailed explanation and reasons behind this e-wave count for another article.

To see an enlarged version of the charts below, please click on it

IMO the current bull market has a couple of more years of run-up left, before any large correction kicks in. I beleive that we are in a Cycle degree wave 4 correction. The last Cycle degree correction (Cycle degree wave 2) lasted for 16 years between 1966-1982. Since i beleive this to be a Cycle degree wave 4 correction, if this correction should take the same time as wave 2, then it should end somewhere around 2016. Although i agree with the bears that this correction will end somewhere around 2014-2016, i part ways with them when it comes to how that correction is going to unfold and where that bear market bottom is likely to form.

There are three schools of bearish thoughts today.

1) Secular bear market

2) Mutli cyclical bear market

3) Cyclical bear market

Secular bear market

The first school "Secular bear market" folks are armageddonists, who beleive a Grand super cycle degree top has formed in 2000 and we should eventually break below the secular lows of 1982 at DOW 769. This school comprises primarily of deflationary depressionists. Even before we start talking about a secular bear market, we should at least break below the Oct 2002 lows. Until then this school of thought is an arena of TA fantasy and/or delusion.

Multi-cyclical bear market

The second school of thought beleives that we are in a secular bear market, yet they can't take the leap of faith a la Prechter to call for market lows below the prior secular bottom at 1982. It's kind of oxymoronic to call we are in a secular bear within the context of a secular bull, without calling for price lows below the prior secular lows of 1982. Although the term "Secular" is loosely bandied about by this scool, they are in fact calling for a multi-cyclical bear market. Obviously this school defines the secular bear in terms of time, by being non-commital on price. This school has a combination of deflationists, hyperinflationists and kondraitief theorists.

Cyclical bear within a Secular bull

The third school (includes me) believes that we in a secular bull market, but a cyclical bear is unfolding in the context of a secular bull. The very fact that the S&P 500 suffered a 50% correction, the largest correction since the advance begun in 1982, means that the secular bull from 1982 has ended. A secular bull ending does not put us automatically in a secular bear. The end of the secular advance has given birth to a cyclical bear, once complete, should start another secular advance.

What's happening now ?

Bears argue that the bear market did not end in 2002. Two main reasons often cited are that we did not see the capitulation in terms of sentiment compared to the prior bear market lows. The P/E did not revert to the historic mean or to the levels seen in prior bear market bottoms.

But one has to remember that cycle degree corrections are rarely simple A-B-C type corrections. Bull market often begin with as few folks on its back as possible. We live in an information age and every average bear out there knows that you buy stocks for long term when there's blood on the streets. Every average bear knows that the time to invest for the long term is when the P/E reverts back to single digits, like it did in 1982. Every average bear knows that a wave C will follow a wave A. In other words, there's an army of wannabe Warren Buffets waiting for the blood on streets to buy this market with both the hands. As the market keeps advancing relentlessly, as it has been since the 2002 lows, the bearish emotion and bearish frustration keeps rising. The thinking among the bears predominantly today is "I am smart and will wait in cash. Let the lemmings be led. When the bulls lose their shirts and the P/E revert to the bear market bottom levels, i will buy cheap". Will the market accomodate this army of bears waiting to buy cheap or shorting this market recklessly ? If history is any guide, these folks will capitulate big time, right near the market top. Market has its own devious ways of keeping most folks out the market.

Bull markets do not begin when the economy is in a state of utopia. It needs that constant wall of worry, to keep the majority from participating. I think the housing market decline over the next few years from the mania top of 2005 will provide fresh fodder for the bears to worry and the wall of worry for the bull market to climb. In my opinion, the housing and the deteriorating economic fundamentals going forward will be the hook which will keep the majority from participating in the bull market going forward.

The best way to predict the stock market IMO is to look at the stock market itself. You can't predict the stock market by looking at Bonds, Dollar, Gold or even the Economy for that matter. Although correlations exist between these markets, those are not static correlations, but one which changes over time. What was the stock market saying in 2002 Oct ?. Well, it was a screaming bear market. Being bearish then was the right thing to do. Bears extrapolated the market decline into the end of civilization. The market demise was predicted with rational certainity using various TA methodologies, but all arriving at the same conclusion and the same dates for dark ages. All archived discussions at longwaves.net should be an eye opener for all the new bear cubs that are being born today. What went wrong with these folks ?. ("These folks" include me as well - i was a raging bear then !). Kondraiteif winter, a wave 3 of 3 down, currency collapase, a depression that would put 1929 to shame, credit implosion, housing bust, breadlines et al ? I think the problem lies in trying to predict one unknown variable with another unknown - The two variables being economy and the stock market.

Where are we now ?

The monthly trend turned up in the stock market in the fall of 2003 and since then we have been in a bull market. I went back and searched as to what happened when the monthly trend turned up after a crash or a major selloff. I have shown five examples here - 1929 DOW crash, 1987 DOW crash, 2000 S&P meltdown, 2004 BSE (Bombay stock exchange) crash.

They all exhibit the same characteristic. Once the monthly trend turns up from a "crash bottom", they start a 45 degree ascent, slowly grinding sideways to up, keepping the bears hopes alive. The momentum divergences on the monthly charts keep the bulls from not talking any long term bets. The 45 degree ascent also is a psychological barrier for making long term bets as it looks ugly on the charts. The e-wavers keep calling it a corrective advance until new recovery highs are made. The memories of the prior meltdown also makes it difficult to make long term bets. Essentially the majority shys away from making long term bets, which results in a choppy sideways-to-up grinding markets without a sustained trend on the daily charts. However the trend is clear and visible on the monthly charts. This market profile/structure and the associated psychology makes sure that the majority is out of the bull market and market keeps climbing the constant wall of worry without creating euphoria quicky.

The slow sideways advance also helps to correct the P/E ratio downwards. As we have seen the S&P has advanced nearly 550 points from the 2002 lows, while the P/E has been declining. Now as long as the stock market keeps advancing at a slower rate than the earnings growth, we could end up seeing a P/E in the low teens or even single digits, at all time highs on the SPX. Imagine the horror among those waiting to buy this market at low P/Es, when forced to buy at ATH on SPX. Of course, i am just extrapolating what has happened from 2002 lows going forward, which may or may not happen - but is not something beyond the realm of possibility, given what has happened so far !

Now how can a corrective structure/advance take out the prior market highs ?

Under e-wave, we have upward biased corrective structures and downward biased corrective structures. Flats and Zig-zags are downward biased corrective structures in an uptrend. What most bears are expecting today is a regular flat or zig-zag taking us below Oct 02 lows.

Running Flat (or a irregular flat ) and Running triangles are examples of upward biased corrective structures in an uptrend. In case of Running flat or Irregular flat, the wave B highs are formed above the wave A highs and the wave C lows form above the wave A lows. I belive we are in one of these two upward-biased corrective formations and below are the e-wave counts of what i think is about to transpire over the next few years.

Now why do i think that the market is forming one of these upward biased corrections as opposed to downwards biased corrections(like a zig-zag or a regular flat) ? The reason is the message sent by the markets itself at this point. Think about it. DOW is just 200 points below the all time highs. One big day could put us into ATH and crush the secular bear market argument. Now will the bears concede defeat if DOW makes ATH ? Bookmark this - DOW ATH will only make the bears more bearish. If DOW ATH were to occur, then the argument will shift to the massive inter-market divergences between the DOW, S&P and the Nasdaq. So the bears will start arguing that Nasdaq and S&P made their secular tops in 2000, but DOW is making it's secular top in 2006. In other words, the bearish sentiment will rise to all time highs, with the all time highs in DOW. Bottomline is as the market advances from here, the sentiment which is already extremely bearish will only start getting even worse. Bears have been arguing that Fed has painted itself into a corner. In reality, it's the bears who have painted themselves into a corner here, if the DOW were to make ATH. They can neither remain bearish nor can they turn bullish. The real capitulation would only come later with ATHs in SPX.

Putting the sentiment argument aside, let's look at the structure of the market from 2003 lows. Clearly we are in the middle of a massive upsloping channel from the 2004 highs.

This is not a wedge, as it does not satisfy any of the ending diagonal requirements in term of structure and internal wave relationships. As the structure has been maturing from 2004, it is getting more and more clear that it's a large irregular flat from 2004. The upsloping nature of the correction itself attests to the upward bias of the markets. Once the upper trendline from 2004 gets taken out, then we could safely say that a wave C of B (of a primary degree has begun). As for intermediate term, i belive that we have not yet seen the 4-year cycle lows. Based on the current wave structure, we could see a move to SPX 1270-1280 by early November and then a quick selloff to around SPX 1240 to fill all the gaps that we have left below, since this IT advance begun in July. The most widely watched 4-year cycle bottom in the history could be in March-April 2007, instead of Oct-Nov 2006 as is being widely anticipated today, based on the current wave structure and time relationship. And the 4-year lows will most likely hold above the 2006 lows.

Cyclically speaking, the extreme right translation of this 4-year cycle also attests to the upward bias of the market and any upcoming 4-year cycle low will be a non-event. The next 4-year upcycle should take out the 2000 top on SPX, based on what the current wave structure is implying.

Last but not the least, the all time highs on the NYSE A/D line is also screaming that this advance is far from over.

Once those 4-year lows are behind us, we should begin a persistant market advance from 2007 in a wave C upmove. Wave C should take us to about SPX 1620 (if wave A = wave C) or about SPX 1860 (if wave C = 1.618 * wave A), before this BULL market tops out, most likely by late 2008 to early 2009. By then, most of the bearish caucus will have worn out/capitulated leading the way for a primary degree wave C decline.

Remember the market could also take the form of a running triangle.

If that happens, it could end up as the bear trap of the millenium, giving no exit for the bears, other than to capitulate en masse. If this scenario were to transpire, then the market volaitlity will start shrinking as we advance into the apex of the triangle, making the market a trader's nightmare. This is what happened from post 1987 crash to 1995 (wave 4), when the market grinded sideways to up slowly and spurted up in a sharp wave 5 move into 2000. This time may not be different, except that its happening at a higher degree !

Here's my big picture e-wave count. I will reserve the detailed explanation and reasons behind this e-wave count for another article.

To see an enlarged version of the charts below, please click on it

IMO the current bull market has a couple of more years of run-up left, before any large correction kicks in. I beleive that we are in a Cycle degree wave 4 correction. The last Cycle degree correction (Cycle degree wave 2) lasted for 16 years between 1966-1982. Since i beleive this to be a Cycle degree wave 4 correction, if this correction should take the same time as wave 2, then it should end somewhere around 2016. Although i agree with the bears that this correction will end somewhere around 2014-2016, i part ways with them when it comes to how that correction is going to unfold and where that bear market bottom is likely to form.

There are three schools of bearish thoughts today.

1) Secular bear market

2) Mutli cyclical bear market

3) Cyclical bear market

Secular bear market

The first school "Secular bear market" folks are armageddonists, who beleive a Grand super cycle degree top has formed in 2000 and we should eventually break below the secular lows of 1982 at DOW 769. This school comprises primarily of deflationary depressionists. Even before we start talking about a secular bear market, we should at least break below the Oct 2002 lows. Until then this school of thought is an arena of TA fantasy and/or delusion.

Multi-cyclical bear market

The second school of thought beleives that we are in a secular bear market, yet they can't take the leap of faith a la Prechter to call for market lows below the prior secular bottom at 1982. It's kind of oxymoronic to call we are in a secular bear within the context of a secular bull, without calling for price lows below the prior secular lows of 1982. Although the term "Secular" is loosely bandied about by this scool, they are in fact calling for a multi-cyclical bear market. Obviously this school defines the secular bear in terms of time, by being non-commital on price. This school has a combination of deflationists, hyperinflationists and kondraitief theorists.

Cyclical bear within a Secular bull

The third school (includes me) believes that we in a secular bull market, but a cyclical bear is unfolding in the context of a secular bull. The very fact that the S&P 500 suffered a 50% correction, the largest correction since the advance begun in 1982, means that the secular bull from 1982 has ended. A secular bull ending does not put us automatically in a secular bear. The end of the secular advance has given birth to a cyclical bear, once complete, should start another secular advance.

What's happening now ?

Bears argue that the bear market did not end in 2002. Two main reasons often cited are that we did not see the capitulation in terms of sentiment compared to the prior bear market lows. The P/E did not revert to the historic mean or to the levels seen in prior bear market bottoms.

But one has to remember that cycle degree corrections are rarely simple A-B-C type corrections. Bull market often begin with as few folks on its back as possible. We live in an information age and every average bear out there knows that you buy stocks for long term when there's blood on the streets. Every average bear knows that the time to invest for the long term is when the P/E reverts back to single digits, like it did in 1982. Every average bear knows that a wave C will follow a wave A. In other words, there's an army of wannabe Warren Buffets waiting for the blood on streets to buy this market with both the hands. As the market keeps advancing relentlessly, as it has been since the 2002 lows, the bearish emotion and bearish frustration keeps rising. The thinking among the bears predominantly today is "I am smart and will wait in cash. Let the lemmings be led. When the bulls lose their shirts and the P/E revert to the bear market bottom levels, i will buy cheap". Will the market accomodate this army of bears waiting to buy cheap or shorting this market recklessly ? If history is any guide, these folks will capitulate big time, right near the market top. Market has its own devious ways of keeping most folks out the market.

Bull markets do not begin when the economy is in a state of utopia. It needs that constant wall of worry, to keep the majority from participating. I think the housing market decline over the next few years from the mania top of 2005 will provide fresh fodder for the bears to worry and the wall of worry for the bull market to climb. In my opinion, the housing and the deteriorating economic fundamentals going forward will be the hook which will keep the majority from participating in the bull market going forward.

The best way to predict the stock market IMO is to look at the stock market itself. You can't predict the stock market by looking at Bonds, Dollar, Gold or even the Economy for that matter. Although correlations exist between these markets, those are not static correlations, but one which changes over time. What was the stock market saying in 2002 Oct ?. Well, it was a screaming bear market. Being bearish then was the right thing to do. Bears extrapolated the market decline into the end of civilization. The market demise was predicted with rational certainity using various TA methodologies, but all arriving at the same conclusion and the same dates for dark ages. All archived discussions at longwaves.net should be an eye opener for all the new bear cubs that are being born today. What went wrong with these folks ?. ("These folks" include me as well - i was a raging bear then !). Kondraiteif winter, a wave 3 of 3 down, currency collapase, a depression that would put 1929 to shame, credit implosion, housing bust, breadlines et al ? I think the problem lies in trying to predict one unknown variable with another unknown - The two variables being economy and the stock market.

Where are we now ?

The monthly trend turned up in the stock market in the fall of 2003 and since then we have been in a bull market. I went back and searched as to what happened when the monthly trend turned up after a crash or a major selloff. I have shown five examples here - 1929 DOW crash, 1987 DOW crash, 2000 S&P meltdown, 2004 BSE (Bombay stock exchange) crash.

They all exhibit the same characteristic. Once the monthly trend turns up from a "crash bottom", they start a 45 degree ascent, slowly grinding sideways to up, keepping the bears hopes alive. The momentum divergences on the monthly charts keep the bulls from not talking any long term bets. The 45 degree ascent also is a psychological barrier for making long term bets as it looks ugly on the charts. The e-wavers keep calling it a corrective advance until new recovery highs are made. The memories of the prior meltdown also makes it difficult to make long term bets. Essentially the majority shys away from making long term bets, which results in a choppy sideways-to-up grinding markets without a sustained trend on the daily charts. However the trend is clear and visible on the monthly charts. This market profile/structure and the associated psychology makes sure that the majority is out of the bull market and market keeps climbing the constant wall of worry without creating euphoria quicky.

The slow sideways advance also helps to correct the P/E ratio downwards. As we have seen the S&P has advanced nearly 550 points from the 2002 lows, while the P/E has been declining. Now as long as the stock market keeps advancing at a slower rate than the earnings growth, we could end up seeing a P/E in the low teens or even single digits, at all time highs on the SPX. Imagine the horror among those waiting to buy this market at low P/Es, when forced to buy at ATH on SPX. Of course, i am just extrapolating what has happened from 2002 lows going forward, which may or may not happen - but is not something beyond the realm of possibility, given what has happened so far !

Now how can a corrective structure/advance take out the prior market highs ?

Under e-wave, we have upward biased corrective structures and downward biased corrective structures. Flats and Zig-zags are downward biased corrective structures in an uptrend. What most bears are expecting today is a regular flat or zig-zag taking us below Oct 02 lows.

Running Flat (or a irregular flat ) and Running triangles are examples of upward biased corrective structures in an uptrend. In case of Running flat or Irregular flat, the wave B highs are formed above the wave A highs and the wave C lows form above the wave A lows. I belive we are in one of these two upward-biased corrective formations and below are the e-wave counts of what i think is about to transpire over the next few years.

Now why do i think that the market is forming one of these upward biased corrections as opposed to downwards biased corrections(like a zig-zag or a regular flat) ? The reason is the message sent by the markets itself at this point. Think about it. DOW is just 200 points below the all time highs. One big day could put us into ATH and crush the secular bear market argument. Now will the bears concede defeat if DOW makes ATH ? Bookmark this - DOW ATH will only make the bears more bearish. If DOW ATH were to occur, then the argument will shift to the massive inter-market divergences between the DOW, S&P and the Nasdaq. So the bears will start arguing that Nasdaq and S&P made their secular tops in 2000, but DOW is making it's secular top in 2006. In other words, the bearish sentiment will rise to all time highs, with the all time highs in DOW. Bottomline is as the market advances from here, the sentiment which is already extremely bearish will only start getting even worse. Bears have been arguing that Fed has painted itself into a corner. In reality, it's the bears who have painted themselves into a corner here, if the DOW were to make ATH. They can neither remain bearish nor can they turn bullish. The real capitulation would only come later with ATHs in SPX.

Putting the sentiment argument aside, let's look at the structure of the market from 2003 lows. Clearly we are in the middle of a massive upsloping channel from the 2004 highs.

This is not a wedge, as it does not satisfy any of the ending diagonal requirements in term of structure and internal wave relationships. As the structure has been maturing from 2004, it is getting more and more clear that it's a large irregular flat from 2004. The upsloping nature of the correction itself attests to the upward bias of the markets. Once the upper trendline from 2004 gets taken out, then we could safely say that a wave C of B (of a primary degree has begun). As for intermediate term, i belive that we have not yet seen the 4-year cycle lows. Based on the current wave structure, we could see a move to SPX 1270-1280 by early November and then a quick selloff to around SPX 1240 to fill all the gaps that we have left below, since this IT advance begun in July. The most widely watched 4-year cycle bottom in the history could be in March-April 2007, instead of Oct-Nov 2006 as is being widely anticipated today, based on the current wave structure and time relationship. And the 4-year lows will most likely hold above the 2006 lows.

Cyclically speaking, the extreme right translation of this 4-year cycle also attests to the upward bias of the market and any upcoming 4-year cycle low will be a non-event. The next 4-year upcycle should take out the 2000 top on SPX, based on what the current wave structure is implying.

Last but not the least, the all time highs on the NYSE A/D line is also screaming that this advance is far from over.

Once those 4-year lows are behind us, we should begin a persistant market advance from 2007 in a wave C upmove. Wave C should take us to about SPX 1620 (if wave A = wave C) or about SPX 1860 (if wave C = 1.618 * wave A), before this BULL market tops out, most likely by late 2008 to early 2009. By then, most of the bearish caucus will have worn out/capitulated leading the way for a primary degree wave C decline.

Remember the market could also take the form of a running triangle.

If that happens, it could end up as the bear trap of the millenium, giving no exit for the bears, other than to capitulate en masse. If this scenario were to transpire, then the market volaitlity will start shrinking as we advance into the apex of the triangle, making the market a trader's nightmare. This is what happened from post 1987 crash to 1995 (wave 4), when the market grinded sideways to up slowly and spurted up in a sharp wave 5 move into 2000. This time may not be different, except that its happening at a higher degree !

Wednesday, June 07, 2006

Inorderly market

Daily Momentum - Sell, Daily Trend - Sell

Weekly Momentum - Sell, Weekly trend - Neutral

Monthly Momentum - Sell, Monthly trend - Up

At this juncture, it's hard to predict what would happen next. One can only observe the market on a day to day basis and look for clues. One thing is for sure - the trend is down. That does not make trading easier, as one has to negotiate with the violent snapback rallies.

Technically the market is in a setup for a nasty decline. The key remains whether the 1245 lows on SPX holds or not. If it holds, we could see a sharp 40-50 points rally. That seems very unlikely at this juncture. On the other hand, a voilent decline looks more probable. Once we break 1245, it would confirm that wave C is in progress, which would target a minimum of SPX 1200. There's simply no support until then. The reason i think that a sharp decline is possible here is based on the internals. Look at the coast-coast movement on the NYSE MCO. The MCO moved from -70 level to +50 level, which was a pretty broad based rally, which sucked in a lot of money into markets hoping that the worst is over or the "V" shaped bottom was in. Now the same MCO has encountered a failure and is now back below the zero level. This has now turned the summation index back down, but this time it's turning down while it's below the zero line !. That's what i call a setup for nastiness. Now the same money which entered the markets pushing the MCO to 50 is panicking and leaving the markets. Once the stops below 1245 are triggered, it could blossom into a climax.

Also notice in the above chart, both the CCI and the MACD are issuing secondary sell signals. Again the MACD is issuing the secondary sell below the zero line. Which is why we are seeing that severe weakness in the marketplace. I had a 120-min buy signal yesterday which is typically good for 20-30 SPX points in a orderly market. All we got today from that signal was a mere 12 points and it abruptly turned down and erased all the gains in one single 120-min bar. That says a lot about the weakness in the markets. This is not the average joe-sixpack panicking here. It's the big boys panicking here. Cash smells good! Capital preservation is the key in these times.

I will try to post my hourly swing buy and sell signals here as the daily will continue to be on a sell for quite sometime.

Monday, May 15, 2006

Running correction

Thursday, May 11, 2006

Perspective is everthing !

This is as trendless a market i have traded in years. Here's the reason. The market is forming a running triangle, confusing the heck out of everyone. Every daily buy signal lasts two days. Every daily sell signal lasts for two days. But that's the function of the market pattern we are in. I will perhaps have my buy signal fail here, very likely. (a break of 1295.56 swing low will cause my buy signal to fail). This will be the second consecutive signal failure this year after 8 consecutive signal successes.

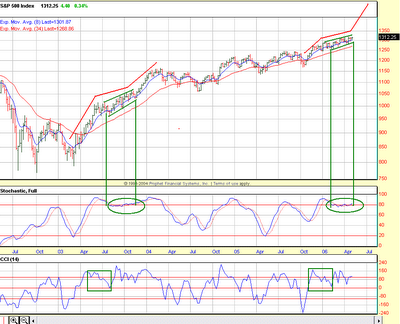

Perspective is everthing. There's already crash talk on the message boards after a day of decline. Just take a loook at the above chart and see if it's bullish or bearish. By no known measures of trend and momentum analysis can the above market structure be construed as bearish. The market entered the zone of vulnerability only twice over the last year, both happened in the fall of 05, which i have circled in green. Look how the EMA ribbons curled over and crossed the blue line. That's the point of maximum concern for longs. That's the zone where mini-crashes can happen. I have checked back in the history for the last 100 years and no crash/mini-crash has come out of the blue before those darn ribbons curled and crossed over. And of course there are certain momentum signatures before those mini-crashes happen.

If my e-wave count is right we should see a bounce tommorow followed by a failure and retest of the SPX 1290-1296 region and a sharp rally following that. The Nasdaq MCO is forming a positively diverging bottom w.r.t price as long as the April lows on the MCO hold. The NYSE cumulative A/D is still in a bullish configuration. What would turn me bearish here ? - A break of SPX 1280, which would turn the intermediate term down. So until proven otherwise, i am looking for a buying opportunity again.

Monday, May 08, 2006

SPX buy signal at Friday's close

On May 4, i wrote

The NYSE MCO has moved above the zero line. Now if we see a good breadth thrust day, that would create a zero-line rejection on the summation index and would be a good intermediate term buy signal.

That's precisely what happened. We got a good breadth thrust day on friday. The summation index had a zeroline rejection. I think the indecision of the markets is behind us and i would consider this as an intermediate term buy signal.

The NYSE MCO has moved above the zero line. Now if we see a good breadth thrust day, that would create a zero-line rejection on the summation index and would be a good intermediate term buy signal.

That's precisely what happened. We got a good breadth thrust day on friday. The summation index had a zeroline rejection. I think the indecision of the markets is behind us and i would consider this as an intermediate term buy signal.

Thursday, May 04, 2006

Don't fight if the market turns up here

VST, my view has not changed that we get a move here to about SPX 1290. But the resilence of this market has been frustrating to short or hold any shorts here. Here's some comparison between 2003 and 2006 purely from momentum and internals perspective. Will history repeat itself ? Time will tell....

The fractal we are witnessing from Oct 05 is an exact mimic of the A-B-C Fractal that we witnessed from March 03 - Jan 04. July 03 thru Oct 03, we were in this running triangle and then broke out of it and melted-up.

We see the same running trianlge here from Feb 06, which is about to finish and switch into a terminal move. My custom Full Stochastic has the exact same signature, flatlining about the 80 line and turning up. Remember overbought weekly indicators turn down. They rarely don't. On those rare instances when they don't turn down and instead turn up, price goes parabolic. That's what we are seeing on the Full Stoch.The CCI has the exact similar signature prior to the beginning of the running triangle and then showing hesitation (i.e chopping around the 100 line) before the big move. Price action then was around the 8 EMA, which is the case now. Similarities are just uncanny.

Sentiment-wise, there was this tremendous disbeleif then, like we have today. Folks were expecting a 9-month cycle bottom then. Now the talk is all centered around the 20-week bottom. Every messageboard i visit, i see this talk about the 20-week cycle bottom. Then in 2003, the internals bottomed during the 9 month cycle bottom while the price made a higher bottom. We are seeing the same again. The summation index is making it's trip to the zero line, i.e the internals are bottoming while the price keeps moving higher.

The NYSE MCO has moved above the zero line. Now if we see a good breadth thrust day, that would create a zero-line rejection on the summation index and would be a good intermediate term buy signal. For now, waiting and watching for the resolution...

The fractal we are witnessing from Oct 05 is an exact mimic of the A-B-C Fractal that we witnessed from March 03 - Jan 04. July 03 thru Oct 03, we were in this running triangle and then broke out of it and melted-up.

We see the same running trianlge here from Feb 06, which is about to finish and switch into a terminal move. My custom Full Stochastic has the exact same signature, flatlining about the 80 line and turning up. Remember overbought weekly indicators turn down. They rarely don't. On those rare instances when they don't turn down and instead turn up, price goes parabolic. That's what we are seeing on the Full Stoch.The CCI has the exact similar signature prior to the beginning of the running triangle and then showing hesitation (i.e chopping around the 100 line) before the big move. Price action then was around the 8 EMA, which is the case now. Similarities are just uncanny.

Sentiment-wise, there was this tremendous disbeleif then, like we have today. Folks were expecting a 9-month cycle bottom then. Now the talk is all centered around the 20-week bottom. Every messageboard i visit, i see this talk about the 20-week cycle bottom. Then in 2003, the internals bottomed during the 9 month cycle bottom while the price made a higher bottom. We are seeing the same again. The summation index is making it's trip to the zero line, i.e the internals are bottoming while the price keeps moving higher.

The NYSE MCO has moved above the zero line. Now if we see a good breadth thrust day, that would create a zero-line rejection on the summation index and would be a good intermediate term buy signal. For now, waiting and watching for the resolution...

Tuesday, May 02, 2006

Get ready for a fast move down !

My expectation over the last few days has been for a move up to SPX 1320 cash and then a move to 1290. The reason i expect 1320-23 is because that's where the weekly resistance bands passes. Generally markets love to kiss those bands before they make a big move. Given all the hesitation and the overlapping action over the last few days, my best guess is that the uncertainity will resolve down towards the 1290 area. The NYSE summation index would also have completed a trip to the zero line by then.

Markets can always throw a curve ball. If for any reason we get a daily close above SPX 1320 then this scenario is wrong and i will have to turn neutral and reasses the situation. Will the market hit the 1320 resistance band ?. I am not completely certain. There's always a possibility of a failure below that level. This is one heck of a nervous market, until the Fed meeting is done with. Bottomline, any sell on 30-min tommorow will get me aggresively short.

Markets can always throw a curve ball. If for any reason we get a daily close above SPX 1320 then this scenario is wrong and i will have to turn neutral and reasses the situation. Will the market hit the 1320 resistance band ?. I am not completely certain. There's always a possibility of a failure below that level. This is one heck of a nervous market, until the Fed meeting is done with. Bottomline, any sell on 30-min tommorow will get me aggresively short.

Monday, May 01, 2006

Sunday, April 30, 2006

Not ready to break out yet

My best take on the market at this moment is that the overall structure remains constructive for a bullish case. But the ingredients from a momentum perspective and from the internals configuration doesn't allow for a breakout just yet !. In the VST (over the next couple of days) we could see NQ test the 1740 area and the SPX cash test the 1320 area followed by a failure. The failure should retest the SPX 1290 area which is now a solid support.

My expectation is largely based on the momentum and EMA configuration that i am seeing on the SPX daily charts. From the internals perspective, the markets have been rallying in the face of the NYSE summation index drifting lower. This means the money is leaving the markets without causing much price damage, which is not necessarily bearish relative to the overall strength of the weekly cumulative A/D line itself. LOL, i was right about the summation index making a trip to the zero line. I thought that would have been accompanied with severe price damage. Boy, was i wrong ! This market seems stronger than i thought. Now once the zero line trip is complete, by which time we should see a minor price damaage, which i mentioned earlier i.e a trip to 1290 on the SPX.

Now the million dollar question in my opinion begins after that ? Will the summation index turn up from the zero line ? If it does, imagine what would happen to the sideline money, the bears etc ? I think that would create some serious upside pressure. I guess it's not clear at this point whether we cross thru the zero line or have a rejection at the zero line. So it's putting the cart in front of the horse. We will deal with it when we get there.

For now, my expectation is a a VST move higher to about SPX cash 1320 and a failure, a retest of 1290 and then.....

My expectation is largely based on the momentum and EMA configuration that i am seeing on the SPX daily charts. From the internals perspective, the markets have been rallying in the face of the NYSE summation index drifting lower. This means the money is leaving the markets without causing much price damage, which is not necessarily bearish relative to the overall strength of the weekly cumulative A/D line itself. LOL, i was right about the summation index making a trip to the zero line. I thought that would have been accompanied with severe price damage. Boy, was i wrong ! This market seems stronger than i thought. Now once the zero line trip is complete, by which time we should see a minor price damaage, which i mentioned earlier i.e a trip to 1290 on the SPX.

Now the million dollar question in my opinion begins after that ? Will the summation index turn up from the zero line ? If it does, imagine what would happen to the sideline money, the bears etc ? I think that would create some serious upside pressure. I guess it's not clear at this point whether we cross thru the zero line or have a rejection at the zero line. So it's putting the cart in front of the horse. We will deal with it when we get there.

For now, my expectation is a a VST move higher to about SPX cash 1320 and a failure, a retest of 1290 and then.....

Subscribe to:

Posts (Atom)