As i posted in the morning, after taking out the 1291.84 swing low, my signal from 3/29 ended in a failure, after seven consecutive good signals this year. A buy signal failure does not automatically generate a sell signal, as i have rules as to what constitute a buy/sell signal. So i turn neutral at this point.

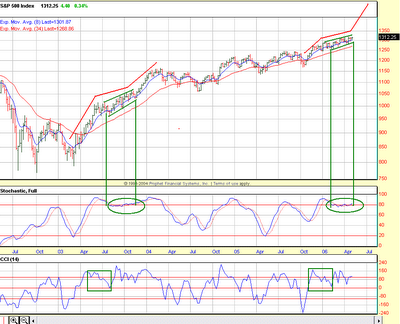

The rules from my system aside, the market is now in a zone of Meltup or Crashes. Here's what's fascinating technically at this juncture. The daily CCI(20) went below -250 at the close on SPX. Here are those rare instances in the last 10 years when the CCI went below -250 and when a ST bottom occured.

3/31/97 - Bottom came 3 days later

10/27/97 - Bottom came one day later

8/28/98 - Bottom came 2 days later

5/25/99 - Bottom came 2 days later

4/14/2000 - Bottomed on the same day

10/11/2000 - Bottom came a day later

3/11/2004 - Bottom came 3 days later

4/15/2005 - Bottom came 3 days later

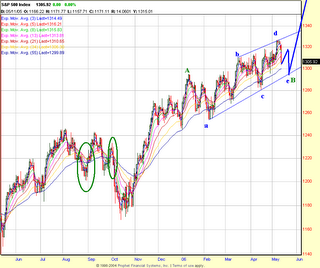

In all of the above instances a ST bottom occured within 1-3 days of CCI closing below -250. In some cases it was a "V" bottom and in some cases the bottoms were retested after a few days of bounce. There's nothing magical as to why this happens every time. If one understands how the CCI is constructed, it's one of the most sensitive momentum indicator out there, as long as it remains between -100 and +100. Once we go above/below +/- 100, the sensitivity drops rapidly. That is a large price movement is required to produce even a small delta on the CCI. Below -250 it becomes almost impossible to push this indicator down anymore. If we were to move from -250 to -300 tommorow, it would require a huge price drop to the tune of 40-50 points on SPX. In other words a mini-crash would be required. And guess what would happen if a mini-crash were to occur, price would snap back like a streched rubber band, cuz it's uncharted territory below -300. So any mini-crash here, if it were to happen, will be all retraced within a matter of hours. Look at April 2000 to get an idea as to what i am talking about or the 1997 mini-crash. If a mega crash like 1987 were to happen, that's a different story. Saying CCI went below -300 and we had a crash in 1987 is totally meaningless without relating to the trend configuration at that given juncture. During 1987, the 8 EMA had crossed below the 34 EMA. The 55 EMA was already sloping down, not to mention the internals then. Today we have a totally different internal configuration and trend configuration. The 8 EMA is still above the 34 EMA. The 55 EMA is still sloping up. The EMA ribbons i am watching are still pointed up to flat. They need to start curling down before we can even start talking about a mini-crash.

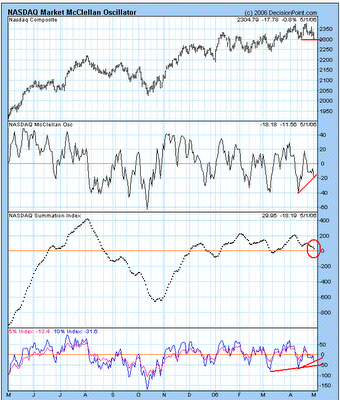

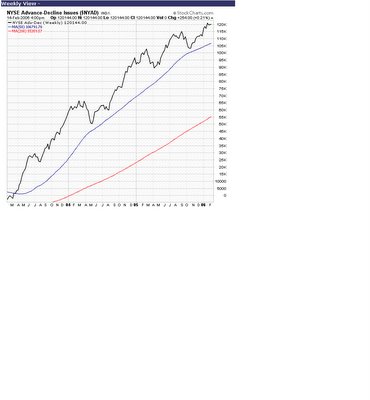

There were a few developments today, as far as the internals are concerened, which begs attention. The NYSE MCO took out the March bottom. The 5% and 10% components of the MCO moved belwo the zero line. The NYSE cumulative A/D line went below the 39 EMA. These are negative developments and in the past have led to intermediate term declines. So what this tells me is even if we rally here, a retest will required before a constructive IT bottom falls in place. On other hand if decline sharply without a bounce, then a "V" shape bottoms becomes a high probability event, based on the CCI configuration. In any case, this is the land of quick or dead. Long and shorts are equally dangerous. With this kind of CCI configuration, we could easily see a 20 point short squeeze or a 30-40 drop kind of moves in a day. It's going to be very volatile the next few days as the bottom gets put in place. Think Oct 05 bottom. It's the territory of daytraders the next few days. If we move up tommorow, i will look for a secondary sell signal. If we move down, i will be looking for a buy signal. For now, i am neutral and will daytrade the heck out this market, the next few days. So i patiently wait for the next signal at this point. Until then, good trading...